I pose this question to all firm owners, not only because I am full of fresh insights after attending the recent PE Summit, but also because a new reality has set into the accounting profession, and, like any change, it’s better to be prepared than to feel like it’s happening to you.

Right now, the majority of accounting firms are comparatively “small” and not likely on the radar for PE investors. This still doesn’t mean you should not have a plan for your future because in order to sustain, you will grow in numerous ways, whether it’s adding technology, staff, new services, digging into a niche, etc. All told, it’s survival and what all businesses do to deal with changing business dynamics.

One of the most pressing considerations for PE investment, from an owner’s or partner’s perspective, is when you do not have a clear plan for your firm’s future. Compound this with the fact that you have indeed grown in the aforementioned ways and have even entered the $1M-$5M realm or more. Where the firm goes from there, or even to sustain those levels, requires proper business planning, you know, like what many of you do (or should be doing) with your own clients.

Problems happen when owners or partners are looking to retire or transition on to other ventures, and little to no planning has been done. PE money looks most attractive here, as well as when you actually do want to make investments for growth, be it in technology, staff, or even acquiring or merging in with another firm. This often requires capital and for a growing number of firms, when PE comes to your door, it’s hard to say no.

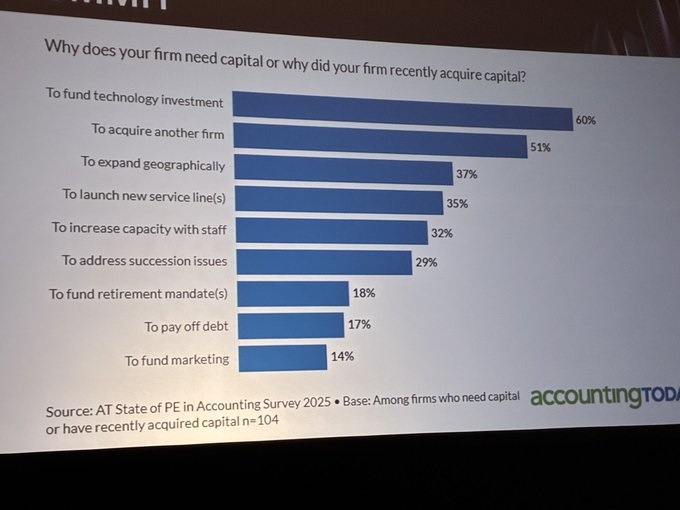

In speaking to firm leaders at PE Summit who chose to “remain independent,” they were either able to structure their firm as an ESOP (employee stock ownership plan), seek out loans from online banks specializing in small businesses (i.e., Live Oak Bank, Axos, Bluevine), or diversify offerings to be more competitive. The event host (Accounting Today) also conducted some research on why firms recently sought out capital. The results were not all that surprising but telling, with technology investment leading the way by a wide margin, followed by firm acquisition, geographical expansion, and launching new services.

Now, I may not have ever run a firm; I’m not in on the everyday decisions firm leaders need to make to keep things steady and perhaps even grow past the next 18-24 months. But both at and outside of the recent PE Summit, I do speak with these leaders and have also known the behavior of private equity since well before my time overseeing the accounting profession.

They are here to diversify their portfolios, and professional services represent an investment in a renewable resource, of sorts. Accounting is a necessity for businesses of all sizes, and they are paying more for those who offer essential services from compliance to planning and advice and everything in between. In short, overall accounting makes money, and PE likes that and wants to be a part of that growth.

Most importantly, and the whole point of this missive, is whether their money is for you or not, you need to know what you want your firm’s future to look like. This isn’t new; plenty of experts in the space have been preaching this level of control for years. And, make no mistake, having a plan for your firm’s succession or eventual future IS control. It is high time you and your partners take it before that future is decided for you.